The Covid crisis has hit forwarders specialising in European road

transport, particularly those working in the automotive and construction

sectors.

Previous issues such as driver shortages and Brexit pale in

comparison with the lack of volumes and low pricing in the current

market.

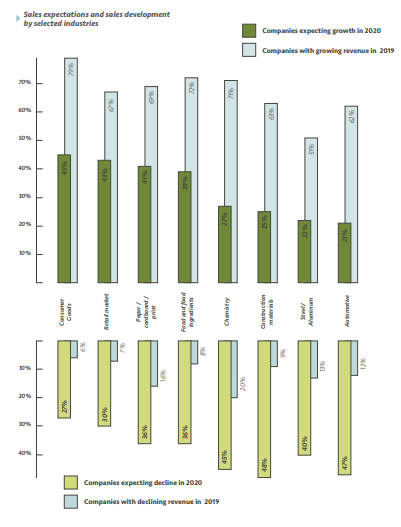

Only 32% of forwarders expect revenues to grow this year, against 67%

last year, according to the European Road Transportation survey by

Transporeon, of more than 1,200 freight forwarders.

Some 38% expect a decline in turnover, against 10% last year, and

nearly half of the chemicals, construction and automotive industries

(45%, 48% and 47% respectively) are expecting declines this year.

Transporeon

Some 77% are seeing a decline in volumes, and 30% are seeing free

capacity in the market due to Covid. Spring 2020 saw a record high in

available capacity, with transport prices correspondingly low. As a

result, only 28% are planning to increase capacity this year – against

46% last year. One in 10 will cut their capacity.

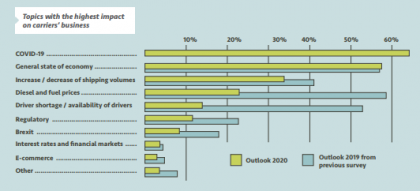

Covid and its consequences dominate forwarder concerns, with 64%

saying it was the issue with the greatest impact on business, with 58%

noting that the economy was a primary issue. Last year, driver shortage

was seen as a real concern for more than 50% of forwarders, now it is

worrying for less than 15%.

Despite severe lockdowns in countries such as Italy and Spain,

freight forwarders in the UK, Ireland and Poland see the greatest impact

of Covid on their own situation, with over 70% of carriers in each

market affected.

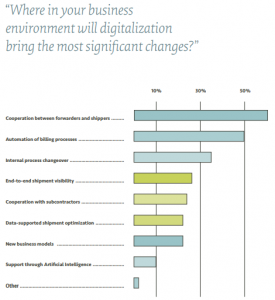

However, digitalisation is one positive, with 74% of forwarders

saying it will improve their business. Nearly 50% said the best

optimisation would be cutting waiting and unloading times, while the

second most important measure was time slot management.

The majority of forwarders give customers the current position of the

shipment when asked, with 42% giving customers live tracking and 38%

give customers the ability to view status messages.

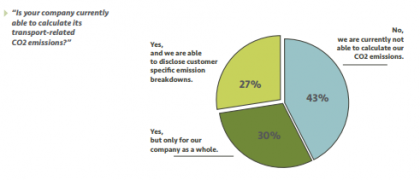

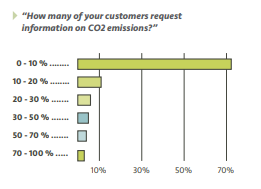

Emissions, however, remain a problem. Nearly 43% are unable to

calculate them, while 72% said less than 10% of their customers ask for

emissions data.

“In the currently very challenging economic situation, it’s

absolutely vital that transport companies, but also our governments,

continue to invest in digitalisation and data-driven infrastructures,”

said Stephan Sieber, chief executive of Transporeon.

“We see this in the survey results: three-quarters of all carriers

believe digitalisation will improve their business situation; and we see

it in the increased uptake in spot market opportunities, which only

become possible through enhanced digital technology.

“In the years ahead, I’m convinced digital technology will not only

make the industry more efficient, but also play a central role in

managing its environmental impact. And clearly we have a lot of work to

do there.”