© Volodymyr Pastushenko

By Alex Lennane

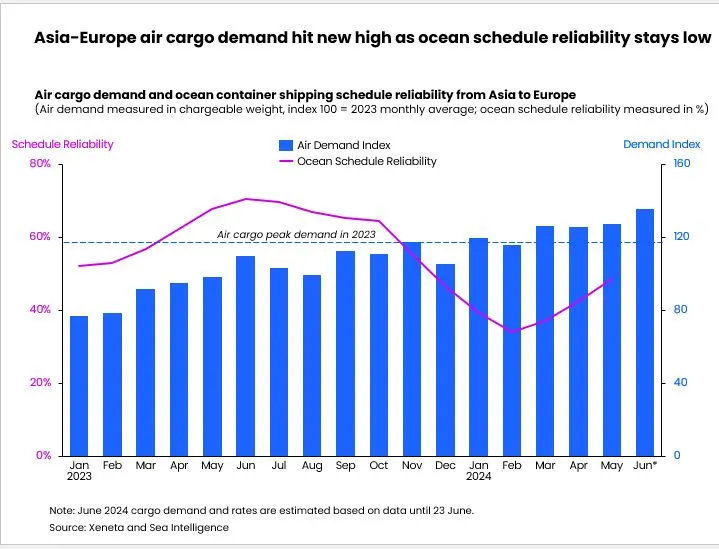

During the pandemic, analysts noted the distinct correlation between poor ocean schedule reliability and air freight demand. Shippers that needed certainty chose air.

But as ocean freight rates begin to creep up to near-Covid levels, shipping reliability is also on the rise this time around.

Despite pockets of port congestion, such as in Singapore, and issues with container availability, data out this week shows that in fact shipping lines are – relatively speaking – sticking to schedules. Sea-Intelligence reported reliability had improved 3.8 percentage points in May over April, reaching 55.8%, the best figure this year so far.

But it is 11 percentage points below May 2023 and the average vessel delay is now 5.1 days – closer to pandemic highs than pre-pandemic lows.

According to new Xeneta data for The Loadstar, air freight demand appears to be on its own upward trajectory – whatever the reliability of ocean. February saw a marked low in ocean performance – but also a slight dip in air freight demand.

Source: Xeneta

However, any further problems in the Red Sea and its surrounds would certainly trigger a demand impact on air, said Xeneta.

“The air freight market is set for a turbulent summer. If the situation in the Red Sea remains as it is, and we see a further squeeze on capacity during the ocean peak season in Q3, then more importers could shift urgent shipments to air freight. This is already happening and will bring back memories of the Covid pandemic,” said Wenwen Zhang, Xeneta’s air freight officer.

Last month WorldACD noted: “The Middle East & South Asia (MESA) origin market … has been particularly impacted by disruptions to container shipping this year.

“Port congestion and vessel capacity shortages in certain key markets [are] driving more cargo owners to airfreight,” it added.

“Average spot rates in week 25 from MESA to Europe remain more than double (+126%) their level this time last year, with Bangladesh to Europe rates averaging $4.29/kg (+165%, YoY), India to Europe rates averaging $3.65/kg (+159%), Colombo to Europe rates at $3.01/kg (+125%), and Dubai to Europe rates at $2.36/kg (+84%).”

Air freight is not only in demand from shippers fearing uncertainty on the sea, however. There is also the rise and rise of ecommerce for disappointed shipping line customers to contend with.

Air capacity is expected to be in high demand in the second half – with Chinese ecommerce platforms estimated to account for some 30% of the space on some ex-Asia routes. As Xeneta chief airfreight officer Niall van de Wouw told the WSJ: “If you as a shipper have not arranged or dealt with your freight forwarder on how to navigate that time, I think you might be in for quite a ride.”

DHL Global Forwarding said it was urging shippers to sign contracts now to guarantee space later.

“If you come to us in October and ask for extra capacity, our answer will probably be no,” CEO Tim Scharwath told WSJ.